Credit Card Calculator For APR & Balance Transfers.

We’re on a mission to simplify credit card calculations.

No more wondering how your credit card APR converts to monthly payments –even if you add that cheeky Greggs’ roll.

- Built for UK & International Audience.

- Simple Calculations.

- No Personal Information Needed.

- Quick & Easy to Use.

Credit Card Calculator

£0

12 months

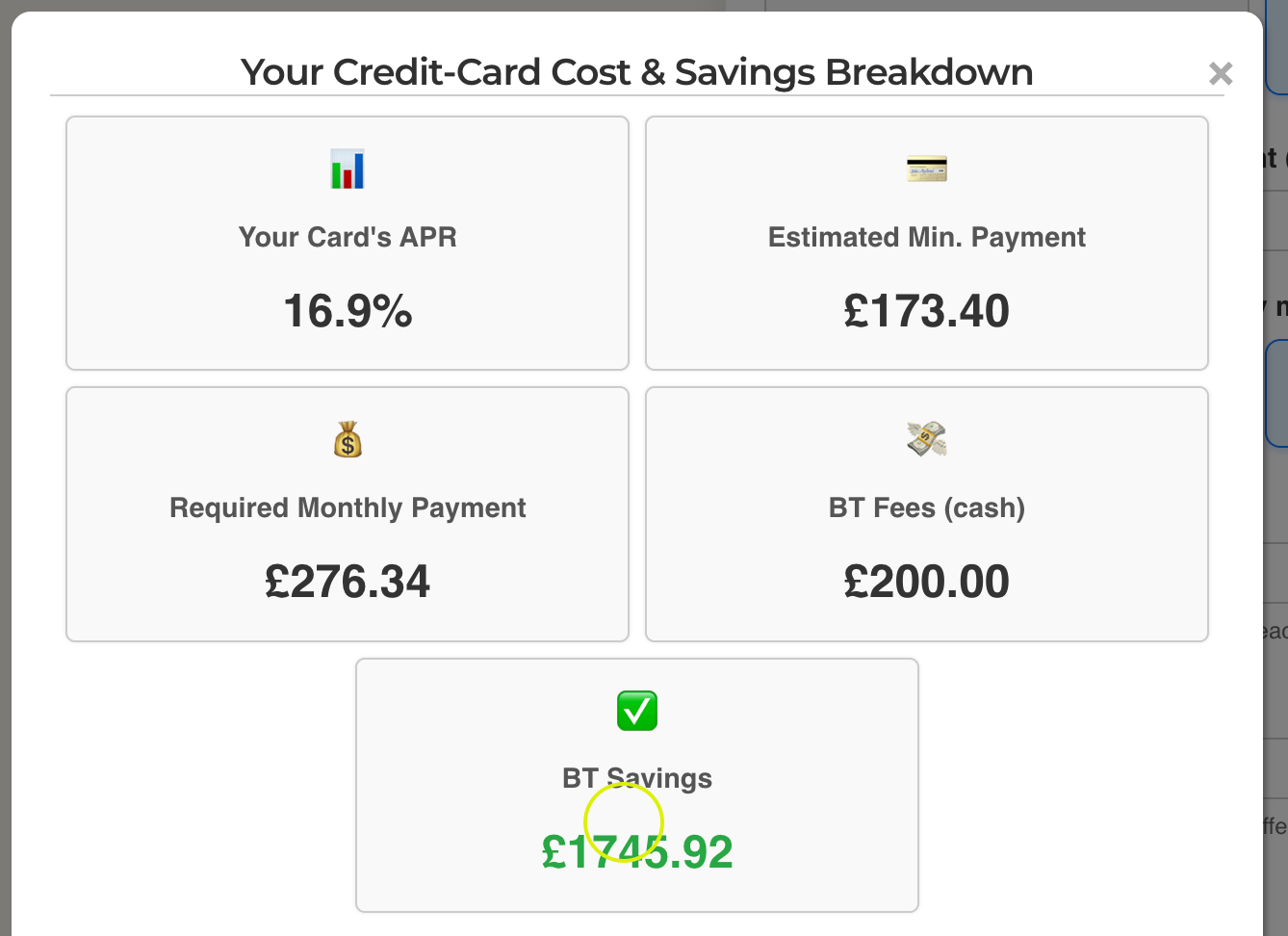

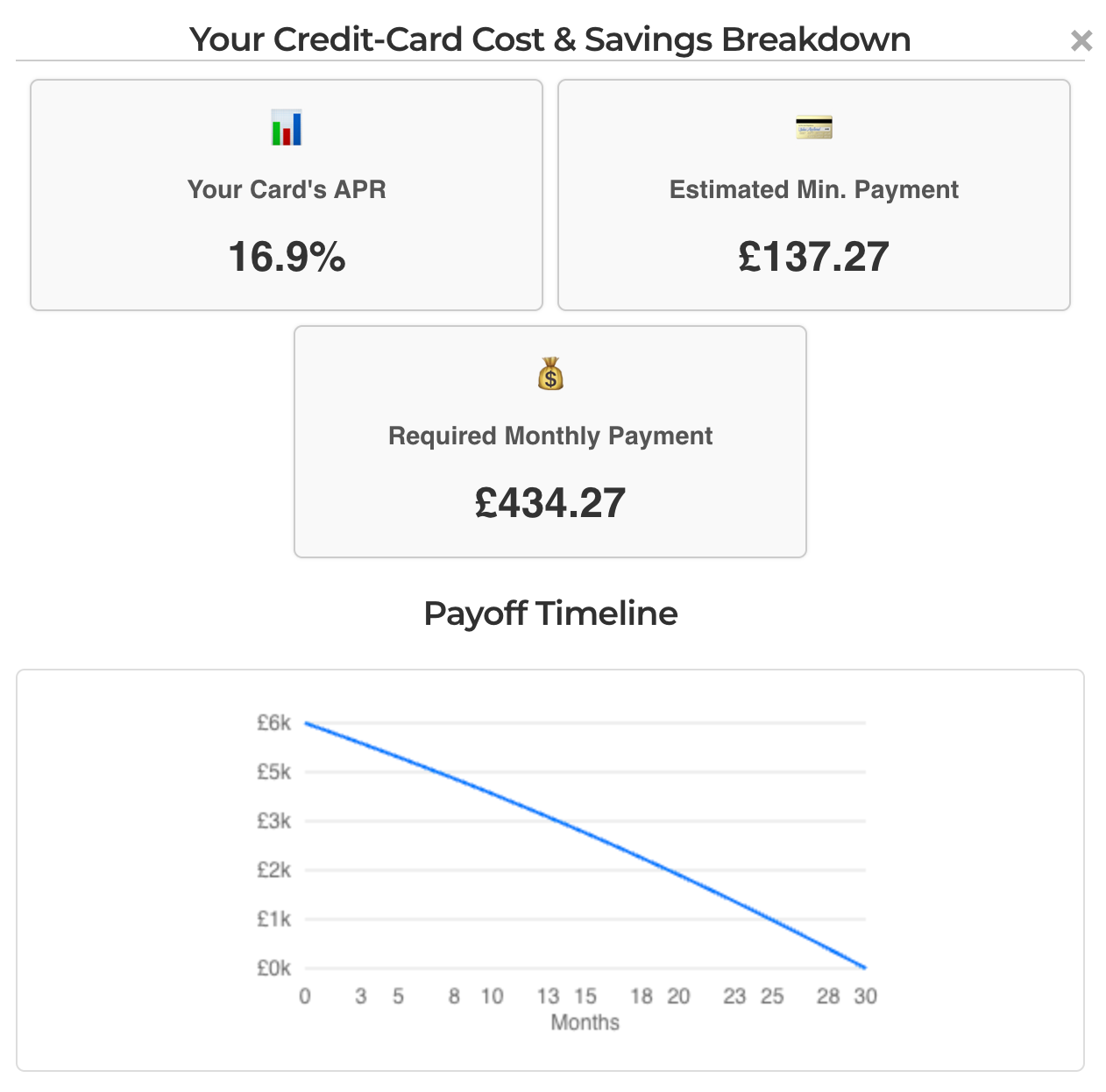

Your Credit‑Card Cost & Savings Breakdown

Your Financial Snapshot

*Estimated based on your balance and payment.

Your Payoff Timeline

Time to be Debt-Free

-

Payoff Timeline

Time to be Debt-Free

-

Overview

💡 Key Insights

✓ Your calculation results are displayed above with detailed breakdowns

✓ Use the export buttons below to save or share your analysis

✓ Consider balance transfer options if they show significant savings

Disclaimer: All information provided is for informational and educational purposes only. This is not financial advice. Results are estimates based on the information you provide and should not be considered as guaranteed outcomes. Please always consult with a qualified financial advisor when making important financial decisions.

The Credit Card Calculator That Keeps It Simple.

Calculate APR & Payments Easily.

No more end of month surprises. Keep on top of credit card payments quickly and easily with simple mathematical calculations.

- Stay on top of payments with APR calculations

- Budgeting & personal finance planning for all ages

- Take charge of your BNPL or credit card payments

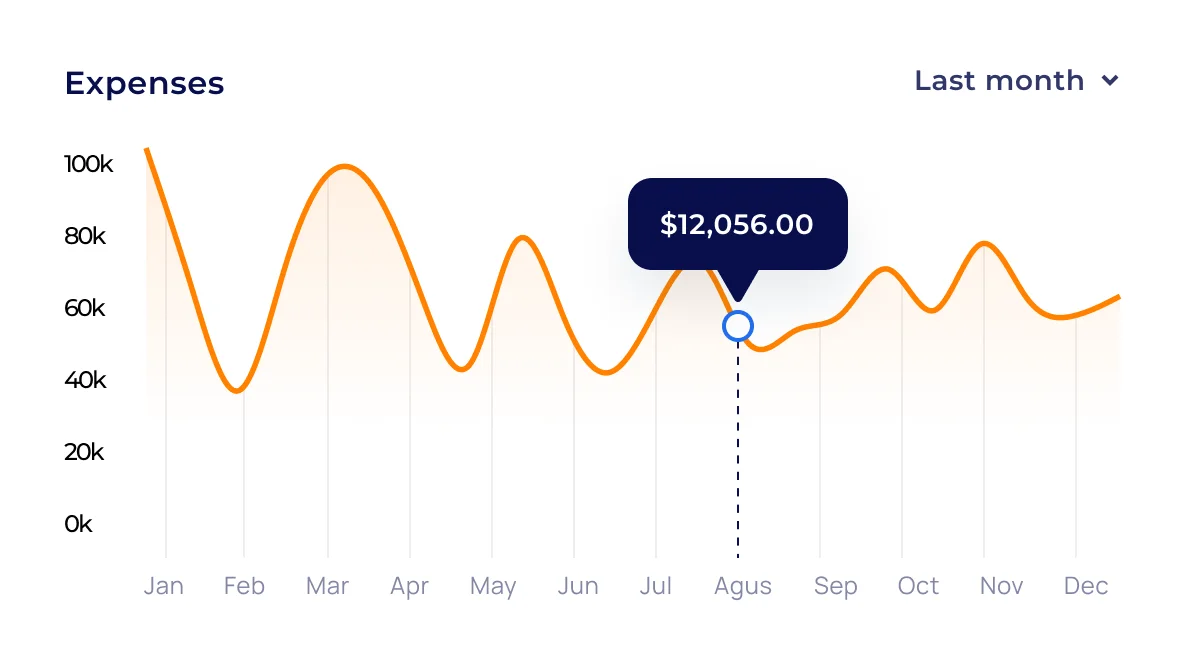

Get in-depth insights on your credit payments.

We build all our results around your information to provide you with personal feedback and a range of possible payment options (timing also plays a factor) for you to stay on top of credit payments.

- Making finance accessible & easier

- Build credit score by staying on top of payments

- Financial inclusion & access for all ages

Finally Understand APR & Credit Card Calculations.

Why Calculate Credit Card APR?

Credit card calculations are notoriously difficult. Could you quickly work out a 28.3% APR on a £5,354 monthly balance? Nope. Neither could we. So we created Credit Card Calculator to help everyone in our position.

What is a credit card?

Credit cards provide unsecured lines of credit to everyday consumers, these often come with rewards and perks, and sometimes with 0% interest for a period. But after this period you will be charged at a higher APR. That’s where we come in.

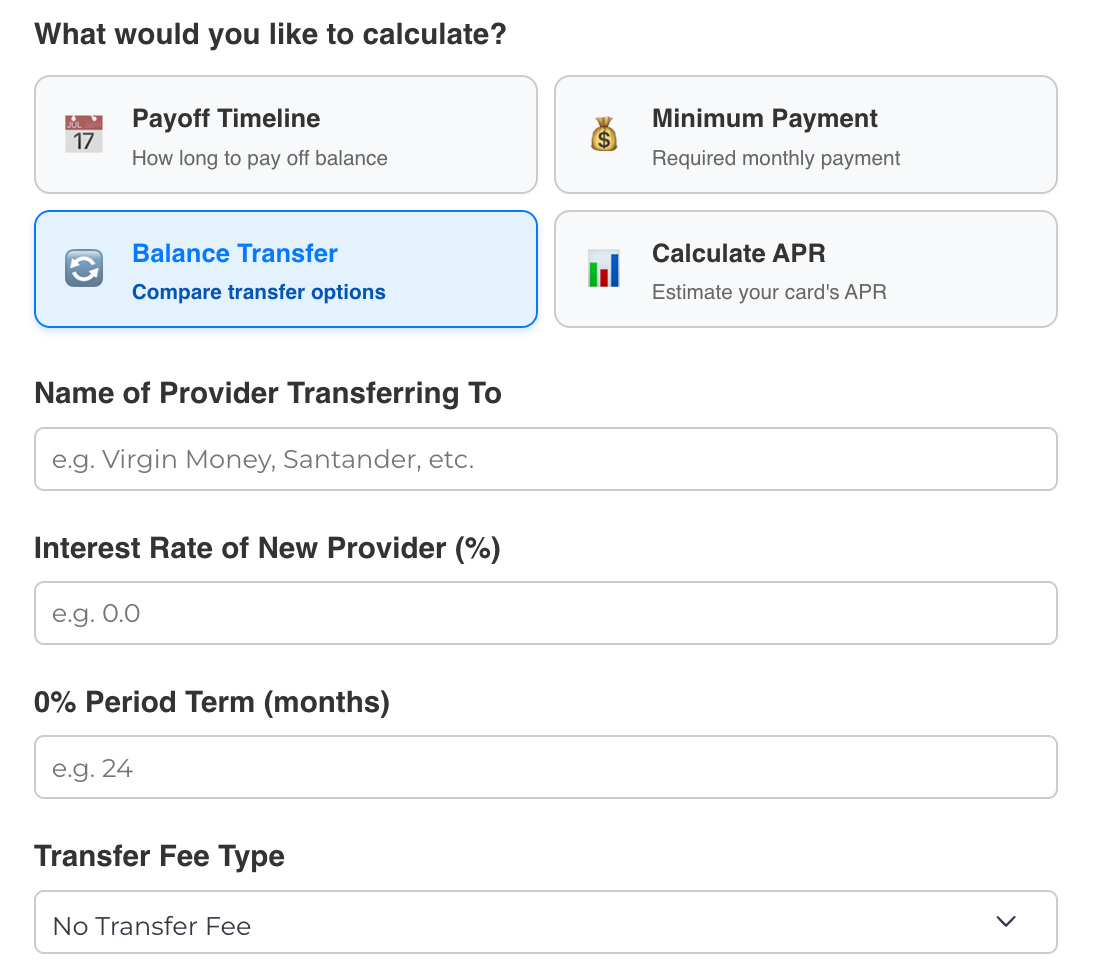

Do you calculate credit card balance transfers?

Yes, we calculate credit card balance transfers as well – we take your existing balance, add any fees to the new card balance and then work out minimum or monthly APR payments according to your requirements.

How do you calculate credit card APR?

You can manually calculate credit card APR by dividing the APR % by 365. But there is also daily interest – i.e.) the additional amount you owe on a given day if you make a transaction, at the respective APR during that period.

Why do I need to calculate my credit card interest?

Calculating your interest on your card (APR) is vital to understand how much you owe in a given month. This avoids unexpected shocks and surprises, but also helps you budget effectively.

Does this apply internationally?

Yes, the calculations here are not exclusive to UK audiences. There may be some regional differences but the broad calculations remain the same – we provide both a range and a precise calculations for your own assessment.

Guided Financial Education for All Ages & Stages.

Custom financial tools tailored to your unique needs – calculate credit payments all in one tool, empowering financial education at every stage.

How to Use Credit Card Calculator

Credit Card Calculator is designed to be simple, quick and easy to use to get a clear understanding of your credit payments – you can start with either your current APR or we can calculate this for you based on our calculations.

-

Simplify credit understanding

-

Access leading calculations & predictions

-

Start with APR or start with payments

-

Export results or download

-

Get range estimates & specific responses

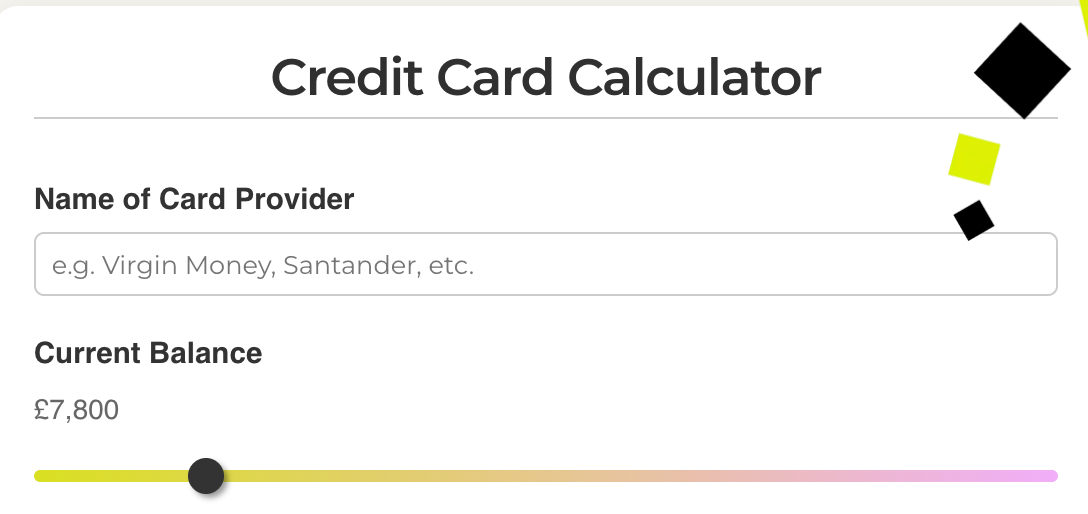

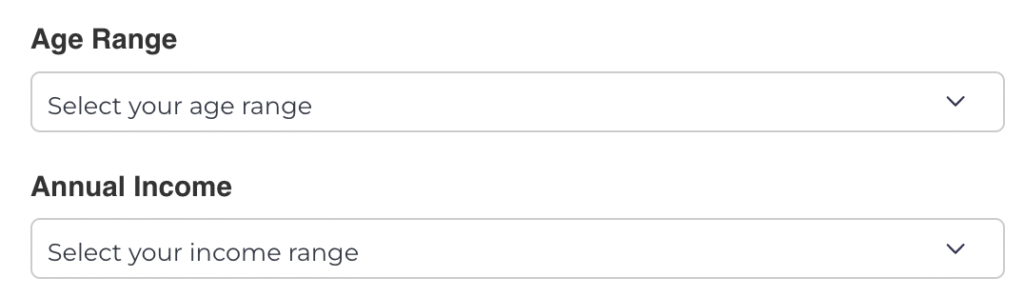

Start with Your Credit Card Provider Name & Key Details

In order to better get a picture, we require some data to help us determine what kind of rate you might already be on using our matching algorithm and may be able to speed up the process. We provide age ranges and income ranges, precisely for this purpose.

-

Flexible calculations

-

APR or payment-focused calculations

-

Accessible for anyone of any age or stage

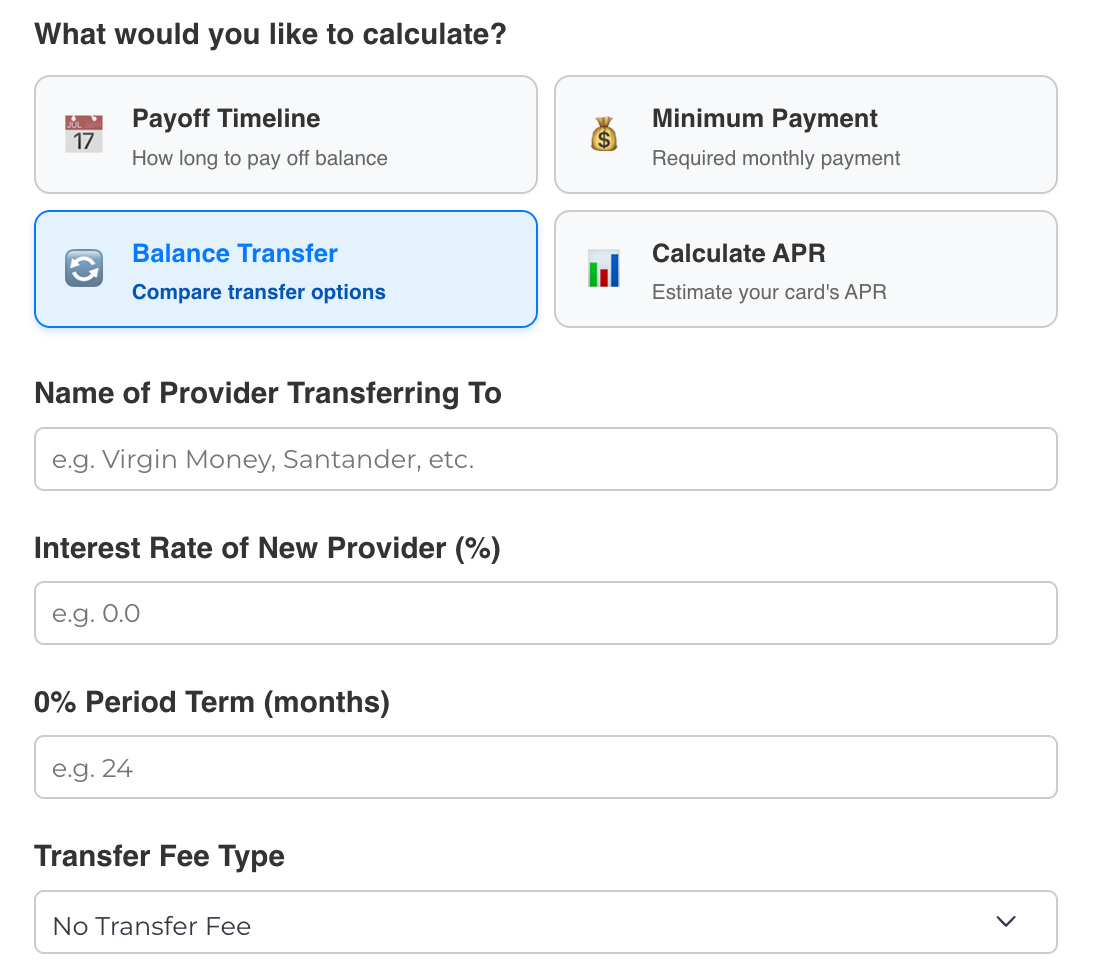

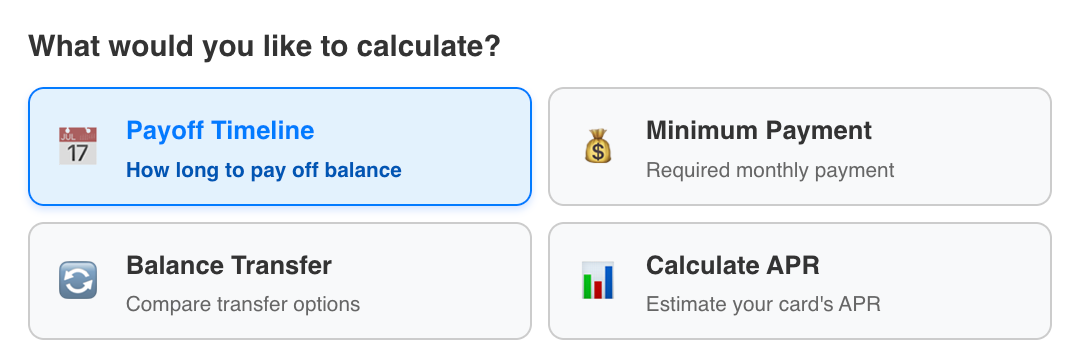

Select What You Would Like to Calculate.

We offer 4 differed type of credit card calculations:

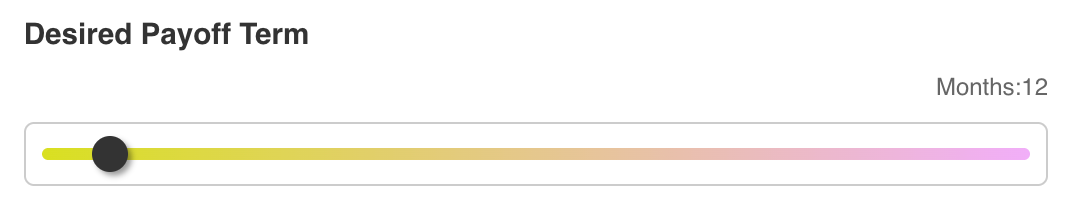

- Payoff Timeline: Calculate how long it will take to payoff a credit card based on your monthly amounts and interest rate.

- Minimum Payment: Calculate how much you need to pay or will need to pay on a new or existing credit card based on the APR.

- Balance Transfer: Calculate how much a Balance Transfer will cost or save you based on your current balance.

- Calculate APR: Calculate how much APR you might be paying on your existing card based on your monthly payments and outstanding balance.

-

No PII data collected (no emails, names, address etc.)

-

Discover how your APR stacks up

-

Built for you & your needs

Get Results.

That’s it. It’s that simple. After you input your information we will calculate your APR (if not already given), your expected monthly payment, Your expected monthly payment range (sometimes payments might differ), and you will be able to export / download your results. Please remember, this is for educational and informational purposes only, and may not be reflective of your actual payment or payments.

-

Discover your APR & minimum payments

-

See how much the balance transfer costs you

-

Export results & save them to your computer

Frequently Asked Questions

Do you help me with my credit score?

No, we do not help with credit scores. We are an educational resource designed for information & entertainment purposes only.

Do you collect any personal data?

We do not collect any personally identifiable data. No emails or names are collected at any point – we use age range and income ranges – and we designed it that way for peace of mind.

Can you recommend a credit card provider?

We do not recommend any single credit card provider. We believe that credit selection is a personal choice. We only help you understand what the potential impact might be in terms of calculations and what your current credit card provider might charge in terms of APR / monthly payments. If you are interested in getting more information on credit cards you can subscribe to our newsletter.

How can I contact customer support for assistance?

Contact us via info@creditcardcalculator.co.uk if you encounter any difficulties using the site or have any further questions.

How accurate is credit card calculator?

Our aim has always been to create the most accurate calculator we can, if there is a discrepancy between our calculations and the monthly payment, first check whether you have had any additional expenditures on the card this month as this can impact your calculation, then check the payment schedule and / or contact your provider who might be able to walk you through the calculations in more detail.

Can I access your services via a mobile app?

Our website is responsive so works seamlessly on mobile but we do not have a mobile app. We are exclusively web-based as this is the way we can reach the most people and create the most accessible tool.

“I discovered I was being charged around 5% per month on my last card, which was crazy. I immediately switched thanks to credit card calculator.”

Alex J., Credit Card Calculator User

Calculating Credit Card Payments Has Never Been This Easy.

Credit Card Calculator facilitates quick and easy credit card calculations – specialising in balance transfer, minimum payments & APR calculations, across all providers, to help you discover how much you could owe every month and how much a transaction could end up costing.

- Explore APR, Balance Transfers & Minimum Payment Calculations.

- Learn about credit planning & budgeting

- Access leading insights & news on credit card calculations.

Frequently asked questions

What does Credit Card Calculator do?

Credit Card Calculator is a completely free online calculator tool that helps you quickly calculate APR – giving educational information based on the data you provide – it is designed to help consumers understand what monthly payments to expect.

Does Credit Card Calculator give financial advice?

No, we never give consumer financial advice. We are designed to inform and educate about potential credit card payments giving you a clearer view than you would otherwise have. For regulated financial advice, please look at the FCA for a list of regulated financial providers.

What are the benefits of a credit card calculator?

Credit card calculators give consumers a quick and easy way to calculate APR, avoiding surprises and unexpected monthly charges. Whilst their predictions may not always be 100% correct, as there other factors that might be involved, they do provide a useful tool to be able to understand potential credit payments.

Do banks provide credit card calculations?

Normally, yes, banks will help you calculate your credit card payments. However, it varies between providers and some are more accurate than others. Normally calculations are done when you balance transfer or open a new credit card vs providing accurate daily or weekly calculations – that’s what we help with.