Why Do Banks Offer 0% Credit Cards?

What’s In It For Them?

When I first saw a credit card with 0% interest, I thought, “Surely there’s a catch.” It almost seemed too good to be true. A card that lets you borrow money and pay no interest for a whole year or more? Where’s the downside?

Well, I signed up. And for the first few months, it felt great. I moved some debt across from a card that was charging me 24%, and I didn’t pay a penny in interest.

But then things got tricky.

That 0% offer ended, and suddenly I was back to paying high rates again. Only this time, I had a bigger balance than before.

That’s when I started asking: why do banks even offer 0% cards in the first place? What’s in it for them?

Turns out, quite a lot.

It’s All About Getting You In the Door

Banks are in the business of making money, not giving it away. So when they offer you a credit card with a 0% interest period — usually on purchases or balance transfers — it’s not because they’re being generous. It’s because they want you.

More specifically, they want you as a long-term customer.

A 0% card is a clever way to get you in the door. Once you’re using the card, they’re hoping you’ll stick around after the deal ends.

And once you do?

- You might keep spending.

- You might not pay off your balance in full.

- You might forget when the 0% period ends.

That’s when the interest starts rolling in.

They Know Most People Don’t Pay It All Off

Let’s be honest. Life gets busy. Bills pile up. And even if you intend to pay off your card before the 0% offer expires, it doesn’t always work out that way.

Banks are counting on that.

In fact, statistics show that a large percentage of people don’t clear their full balance before the 0% deal ends. That’s when they start paying 19%, 24%, or even more on the remaining balance.

So from the bank’s point of view, the 0% deal is a short-term investment. They lose a bit of interest upfront, but they stand to make much more over the longer term.

Balance Transfers: The Hidden Profits

One of the most common types of 0% credit card is a balance transfer card. These let you move existing debt from one card to another, giving you a break from interest for a fixed period.

Sounds good, right? And it can be. But here’s why banks love them:

- Transfer fees: Most balance transfer cards charge a fee of 2-3% of the amount you move. So if you transfer £3,000, that could mean £60-£90 upfront, straight into the bank’s pocket.

- You might not pay it off in time: If the 0% period is 18 months, and you don’t clear the balance by month 19, you could suddenly face a much higher interest rate.

- You might keep spending: Sometimes new purchases aren’t covered by the 0% deal. That means while your transferred balance is interest-free, anything else you spend on the card racks up charges from day one.

Banks rely on the fact that people either don’t read the terms, don’t stick to the plan, or end up using the card for more than just the original transfer.

So yes, a balance transfer can be a great tool to get ahead of your debt. But only if you treat it like a short-term project, not a free pass.

You Might Spend More Than You Planned

This happened to me.

Once I got my new shiny 0% credit card, I told myself it was just for the balance transfer. But the credit limit was higher than I expected. And before I knew it, I was using it for other things too.

That new laptop? It could wait, but it didn’t.

A few dinners out? I’d pay it off soon.

But those extra purchases were not part of the 0% deal. They started charging interest from day one. And I didn’t realise until my next statement.

Banks know this happens. And it’s another way they make money from 0% cards.

Behavioural Traps

This is where it gets sneaky. 0% credit cards are designed to change your behaviour.

They make it easy to:

- Put off paying

- Spend more than you normally would

- Feel like you’re managing your money smartly (when you’re actually stretching it further)

Banks invest millions in understanding how we think about money. A 0% offer is the perfect bait to get you emotionally and financially committed to a product.

Once you’re on the hook, you’re more likely to stay loyal. Even if that means paying more later.

The Card Might Still Be Worth It… If You Know What You’re Doing

Let me be clear: 0% credit cards are not bad. In fact, they can be incredibly useful tools for managing debt or making large purchases without paying extra.

But you have to go in with your eyes open.

Ask yourself:

- When does the 0% period end?

- What’s the APR after that?

- Are there fees for transfers or purchases?

- Can I pay it off before the deal ends?

If you have a plan, and you stick to it, a 0% card can save you hundreds.

But if you forget, delay, or slip into bad habits? It can cost you even more than a standard card.

Use a Calculator to See the Real Numbers

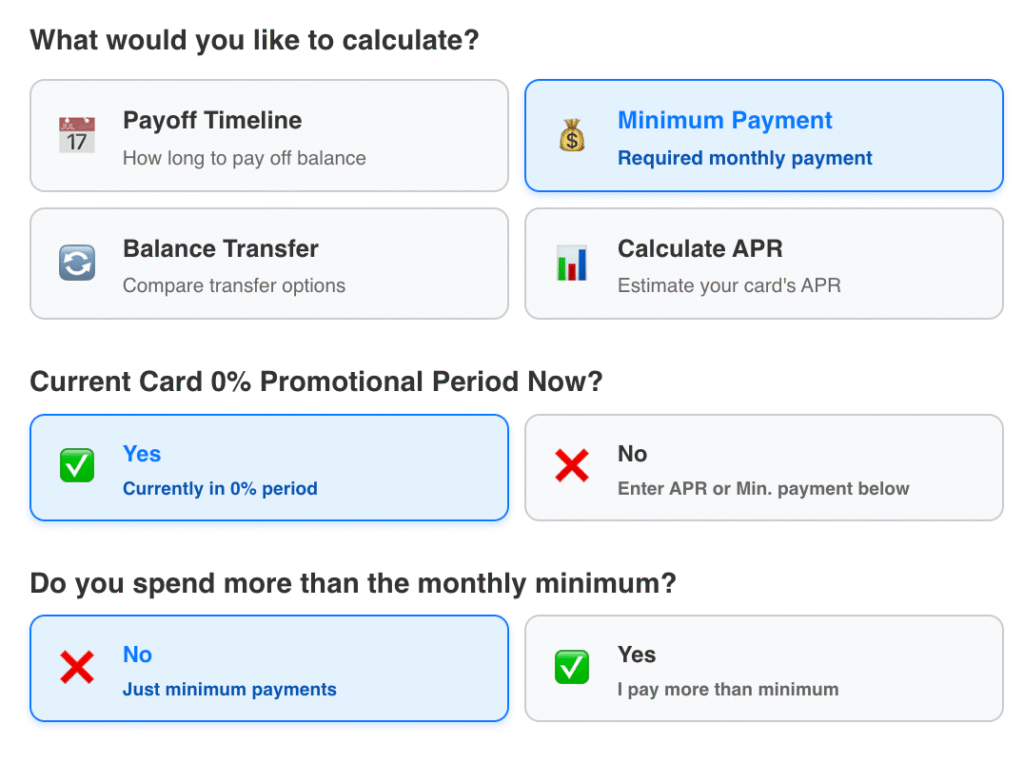

When I finally woke up to how all this worked, I created credit card calculator. You can plug in your balance, your interest rate, or a 0% deal, and it shows you:

- What your monthly payment needs to be

- How much interest you’d save

- How long it’ll take to pay off your debt

It doesn’t give you financial advice — just clear, easy-to-understand numbers so you can make smarter decisions.

And honestly, it helped me get back on track.

In Summary: Why Do Banks Offer 0% Cards?

Because they work.

0% credit cards attract new customers, generate fees, and lead to long-term profits when people:

- Miss the end date

- Spend more

- Keep a balance after the 0% period

If you’re careful, you can beat them at their own game. But if you go in blind, thinking it’s all free money? That’s exactly what they’re hoping for.

Not Financial Advice

Just a quick note: this article and the tools mentioned here are for informational and educational purposes only. They aren’t financial advice. If you’re unsure about what’s right for you, always speak to a qualified financial adviser.

But if you just want to understand your options and make sense of the small print, a good credit card calculator is a great place to start.

Because the more you know, the less they can take you by surprise.

Jordan is a resident advisor and expert in credit cards, personal finance and investing. Having been featured on UK comparison sites & leading business investment sites for his expertise, he lends a careful eye and attention to detail over our more in-depth credit card articles ensuring our standards remain compliant.