How to Calculate Credit Card Minimum Payments.

Why Minimum Payments Keep You in Debt Longer Than You Think…

I used to think making the minimum payment on my credit card was enough. I’d see the number on my statement—maybe £45 or £60—and as long as I paid that, I felt like I was staying on top of things.

But then I noticed something strange: my balance wasn’t really going down. Month after month, I was paying, but it felt like I was stuck in place. It was like trying to empty a bathtub with a teacup, while the tap was still on.

So I started digging into how minimum payments are actually calculated. And what I found was eye-opening.

What Is a Minimum Payment?

A minimum payment is the smallest amount you have to pay your credit card company each month to keep your account in good standing. If you pay less than this—or miss it altogether—you get hit with fees, and your credit score can take a hit.

Sounds fair enough. But here’s the problem: the minimum payment is usually just enough to cover the interest and a tiny bit of your balance. If you only ever pay the minimum, you could be in debt for years.

How Is the Minimum Payment Calculated?

Different banks have slightly different rules, but most of them use a variation of the following:

1. A percentage of your balance Usually between 2% and 4% of what you owe.

OR

2. Interest + fixed percentage of the balance Something like: your monthly interest + 1% of your balance.

OR

3. A fixed amount (usually £5), whichever is greater

So, for example:

- If your balance is £2,000 and your bank requires 3%, your minimum payment would be £60.

- If your balance is lower—say, £150—you might only have to pay £5.

But here’s where it gets tricky. If your APR is high (say, 24%), then most of that £60 is just covering interest.

A Real-World Example

Let’s say:

- Your balance is £2,000

- Your APR is 24%

- Your minimum payment is 3% = £60

Out of that £60:

- Around £40 goes to interest

- Only £20 goes to reducing your debt

So next month, you still owe £1,980. And guess what? That interest starts again.

If you keep paying just the minimum, it could take over 20 years to pay off your balance. And you could pay thousands in interest.

I know that sounds dramatic, but it’s the reality for a lot of people. I was one of them.

Why Banks Like Minimum Payments

Minimum payments are good for the banks. They let you keep using the card, and the longer you take to pay off your balance, the more interest they earn.

It’s a steady stream of income for them. And unless you run into serious trouble, they’re happy for you to just keep paying the minimum.

But if you actually want to get out of debt? The minimum payment is the bare minimum—and not nearly enough.

How to Calculate It Yourself

Want to work out your own minimum payment? Here’s a rough method you can use:

Option A: Percentage Method

- Take your total balance

- Multiply it by the minimum payment rate (usually 2% to 4%)

Example:

- £2,000 x 0.03 (3%) = £60

Option B: Interest + 1%

- First, calculate your monthly interest:

- APR ÷ 12 = monthly interest rate

- 24% ÷ 12 = 2% monthly

- £2,000 x 0.02 = £40

- Then add 1% of balance:

- £2,000 x 0.01 = £20

- So total = £40 + £20 = £60 minimum payment

Again, this is just an estimate. Different banks have different formulas. But it gives you a ballpark figure.

A Better Way to Stay in Control

Once I realised how minimum payments were keeping me stuck, I changed my approach:

- I started paying a fixed monthly amount that was higher than the minimum.

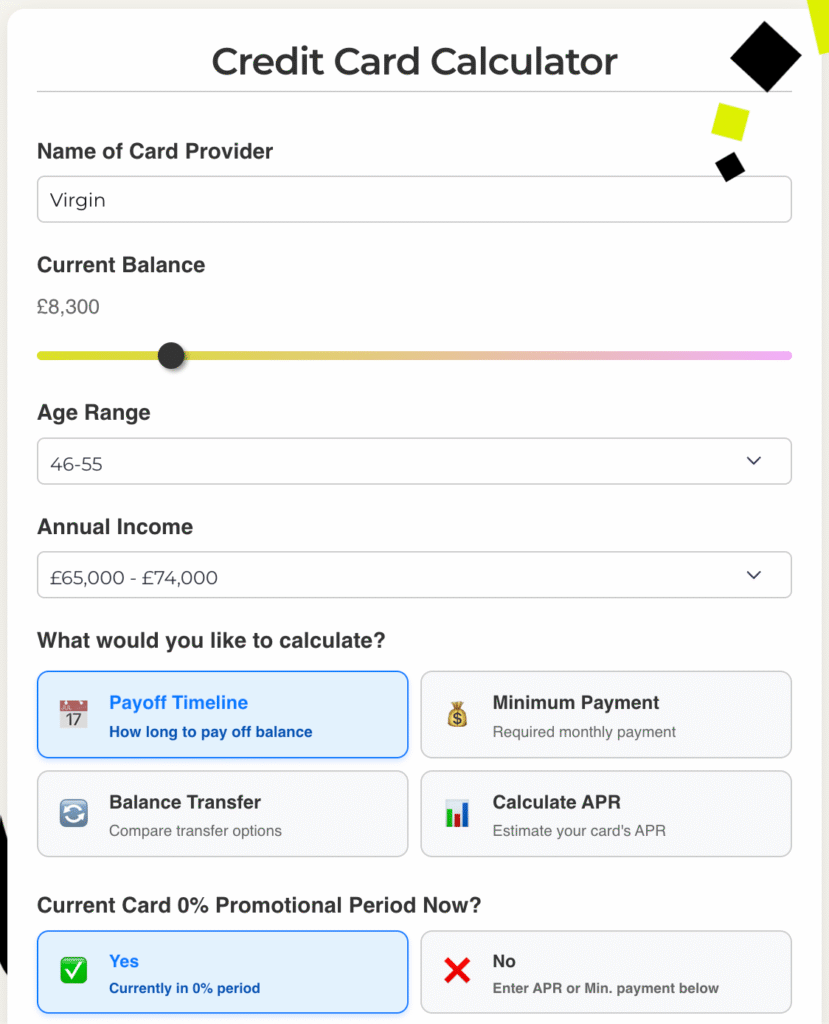

- I used a credit card calculator to see how fast I could pay off my debt if I increased my payment.

- I avoided new charges until I paid off the balance completely.

One of the best tools you can use is a credit card calculator… You can plug in your balance, interest rate, and payment, and it shows you:

- How long it will take to pay off your card

- How much interest you’ll pay overall

- What happens if you pay more than the minimum

It doesn’t give financial advice. It just shows you the facts in simple numbers. And for me, that made all the difference.

Final Thoughts

Minimum payments are designed to keep you afloat, not to help you get ahead. They’re the credit card version of treading water—you’re not sinking, but you’re not going anywhere either.

If you’re only paying the minimum right now, you’re not alone. But just know this: the faster you can pay a little extra, the faster you can break free from the cycle.

Try using a calculator to see where you stand. It might be just the motivation you need to take that next step.

Note: This article is for educational purposes only and should not be taken as financial advice. Always speak to a qualified adviser if you’re unsure about your financial situation.

Jordan is a resident advisor and expert in credit cards, personal finance and investing. Having been featured on UK comparison sites & leading business investment sites for his expertise, he lends a careful eye and attention to detail over our more in-depth credit card articles ensuring our standards remain compliant.