Best Credit Card Calculators in the UK.

Managing credit card debt isn’t just about paying on time. It’s about knowing exactly what you owe, what your interest is costing you, and how long you’ll be in debt if you only pay the minimum. That’s where a good credit card calculator becomes essential.

We’ve tested and reviewed the best credit card calculators online. Some are simple but limited. Others are better suited to beginners or just provide raw APR figures. And then there’s Credit Card Calculator, which in our view, is the most complete and user-friendly credit card calculator on the market for Balance Transfer & Minimum Payment, and APR Calculations

Here’s a breakdown of the top 5 calculators available right now.

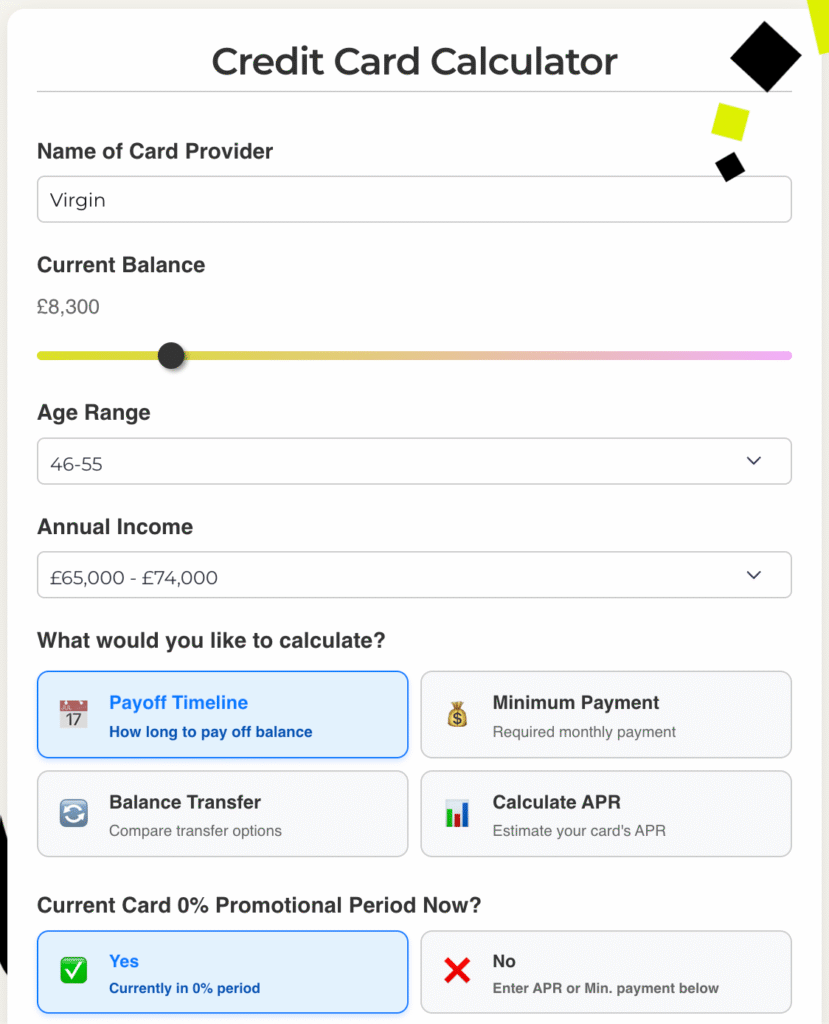

1. Credit Card Calculator (Best Overall)

This calculator was clearly built by people who understand how consumers think about debt. It doesn’t just ask for your balance and APR. It walks you through the nuances of real-life credit card usage and helps you in multiple scenarios.

What sets it apart:

- Handles minimum payments, monthly contributions, balance transfer comparisons, and APR estimations.

- Supports both people in a 0% promotional period and those paying full interest.

- Allows you to enter either your APR or your estimated minimum payment.

- Tracks spending on the card vs. repayments made, so you can see if you’re actually reducing debt month to month.

- Takes into account whether you pay more than the minimum.

Key Features:

- Payoff Calculator: Tells you how long it’ll take to clear your balance.

- Minimum Payment Estimator: If you don’t know your APR, you can still calculate what you owe each month.

- Balance Transfer Calculator: Calculates how much you’d save by switching to a 0% balance transfer offer, including fees.

- APR Calculator: For users who don’t know their exact interest rate.

- Visual Timeline & Insights: Breaks down your journey to becoming debt-free.

- Copy Analysis and Save Results: Useful for budgeting, sharing with advisors, or tracking changes over time.

Example Output:

You’re currently paying £237.18 per month and will be debt-free in 3 years. You’ll pay £1718.41 in interest if you stay on this plan. A balance transfer offer could save you £872.49 in interest (after fees) and help you pay off your debt 4 months faster.

It’s intuitive, flexible, and gives you clarity on how to get out of credit card debt faster. Whether you’re trying to understand your payoff timeline, comparing APRs, or planning a transfer… it’s all there in one clean interface.

2. MoneyHelper Credit Card Repayment Calculator (Backed by UK Gov)

MoneyHelper (formerly the Money Advice Service) offers a simple, trustworthy calculator aimed at helping consumers understand how long it’ll take to pay off their balance.

Pros:

- Backed by the UK Government

- No ads, no affiliate push.

- Simple inputs for monthly payment and interest.

- Great for basic what-if scenarios.

Cons:

- Doesn’t handle 0% promo periods or balance transfer comparisons.

- No export/share features.

- Limited flexibility on inputs.

This is ideal for people who already know their APR and want a clean, no-frills tool. But it lacks the broader budgeting context of CreditCardCalculator.co.uk.

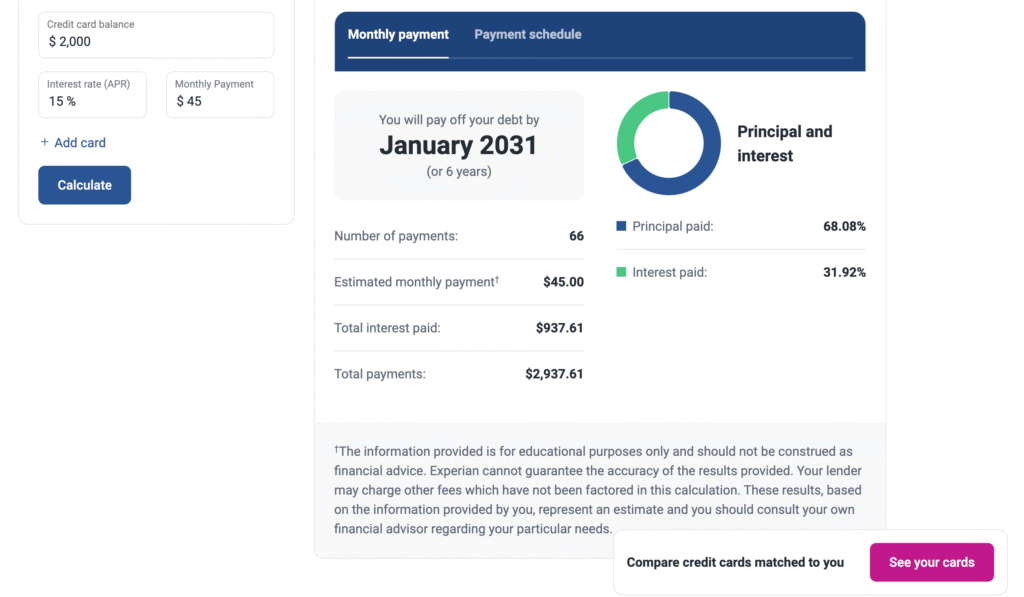

3. Experian Credit Card Payoff Calculator

Experian’s calculator is designed to help people understand how changes to their monthly payments impact payoff time and total interest paid.

Pros:

- Easy to use with sliders for monthly contribution.

- Ideal for visualising the effect of overpaying.

- Useful if you’re already an Experian user.

Cons:

- No balance transfer modeling.

- Requires APR input.

- Less flexible than it looks (can’t input spending behaviour or promotional rates).

Still, it’s polished and educational, especially for those just starting to take control of their finances.

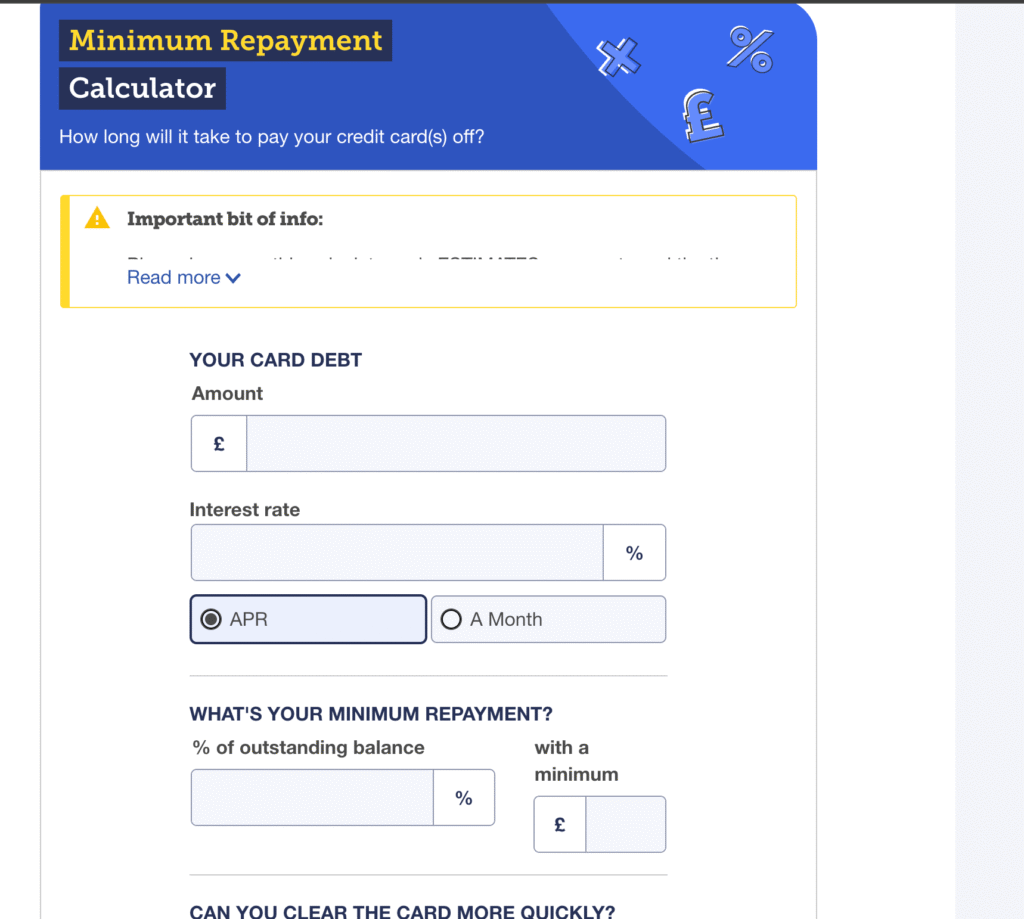

3. MoneySavingExpert Credit Card Minimum Repayment Calculator

This is one of the oldest and most reliable UK-based calculators for estimating how long it’ll take to repay your credit card if you only make the minimum payments.

Pros:

- Designed specifically for UK card structures

- Strong educational overlays

- Good for showing the shocking effect of long-term minimum payments

Cons:

- Only calculates minimum repayment timelines

- Doesn’t calculate APR or let you customise payment amounts

- No transfer comparison or savings overlay

Useful if you want to scare yourself straight—but limited for deeper planning.

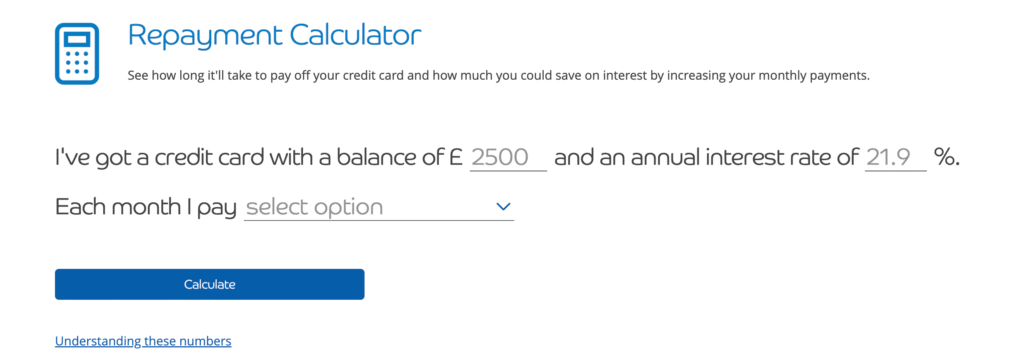

5. Barclays Repayment Calculator

Barclays offers a calculator on their website that models how your repayments will affect your balance. It’s designed for existing Barclays cardholders, but can work with any numbers.

Pros:

- Trusted bank

- Allows APR and custom payment inputs

- Simple interface

Cons:

- Not designed for balance transfer comparisons

- No minimum payment calculator

- Geared toward Barclays products, no export or insight features

Nice for existing Barclays customers, but doesn’t match up to the wider functionality of tools like CreditCardCalculator.co.uk.

Final Verdict

If you want a real breakdown of what your credit card is costing you, Credit Card Calculator is the clear winner. It handles every scenario a user might face: minimum payments, balance transfers, APR calculations, daily spending effects, and even 0% promo periods. You get visual results, detailed breakdowns, and the option to copy or save your plan.

The others are fine for niche cases. But if you want a true end-to-end picture of your credit card strategy, there’s only one that does it all.

Disclaimer: All tools listed are for informational use only. Always seek financial advice if you’re unsure about your debt repayment strategy.

James is a leading expert in UK personal finance (saving, investment & borrowing) - leading both Credit Card Calculator & ISA Interest Calculator tools. He has 8+ years of experience in personal finance, credit / borrowing & ISA savings. He has been regularly featured on several prominent business & investment-related sites in the UK. When he is not working he enjoys spending time with his daughter and hikes in the Scottish highlands.