How To Calculate Credit Card APR.

My Credit Card APR Cost Me Hundreds…

I remember the moment I realised I was in trouble. I was sitting at the kitchen table with a coffee, going through my online bank statements (don’t judge, it was a slow weekend!), and something didn’t feel right. My credit card balance hadn’t dropped much in months. In fact, it looked almost the same as it had at the start of the year. That didn’t make sense to me. I’d been making my minimum payment like clockwork. I hadn’t bought anything new on the card. So why wasn’t it going down?

So I did something I hadn’t done before: I looked at the interest rate. And what I found genuinely shocked me.

The APR on my card was 24.9%. I stared at the number, blinking, trying to work out what it actually meant.

Turns out, it meant a lot more than I thought.

What Is APR (and Why Should You Care)?

APR stands for Annual Percentage Rate. It’s the cost you pay each year to borrow money on your credit card, expressed as a percentage. So if you have a balance of £1,000 and your APR is 24%, that means you could be paying up to £240 a year in interest if you don’t pay the balance off.

Now, that’s an annual number, but credit card interest is actually charged daily, and compounds monthly. That means interest builds on top of interest.

Here’s where it gets sneaky: when your 0% introductory offer ends, that high APR kicks in immediately. And unless you’re paying off the full balance every month, you start to rack up interest.

Like I did.

How to Calculate APR Payments

Let’s say your balance is £2,000. Your APR is 24%. You make the minimum payment each month, which is typically around 2.5% of your balance or £5 (whichever is higher).

In this case, 2.5% of £2,000 is £50. So you pay £50 each month.

Easy, right?

Not quite. Here’s what actually happens:

- Month 1: You pay £50. But around £40 of that goes to interest. Only £10 goes to the balance.

- Month 2: You now owe £1990. Interest is still being added daily.

- Month 3 onwards: The payments stay roughly the same, but the amount going to interest remains high.

At that rate, it would take over 20 years to pay off the full amount.

And you’d end up paying over £2,600 just in interest.

I’ll say that again: £2,600 in interest, on a £2,000 debt.

That’s why understanding your APR matters. It’s not just a number on a piece of paper. It’s money out of your pocket.

My Personal Wake-Up Call

I thought I was being responsible. I was paying the minimum on time, every time. I assumed that was enough. But in reality, I was throwing money away every single month.

The worst part? I didn’t even know what questions to ask.

- I didn’t know what APR meant in practical terms.

- I didn’t realise how little of my payment actually went toward reducing my debt.

- I didn’t understand that promotional rates don’t last forever.

I felt like the credit card company had tricked me. But really, I’d tricked myself by not taking the time to understand how it all worked.

How to Actually Calculate APR (With Real Numbers)

OK, let’s dig in here. If your APR is 24%, that’s the annual rate. Divide that by 12 months and you get 2% monthly interest.

But it’s not that simple… Interest is charged daily, so the actual amount depends on your daily balance and something called the daily periodic rate.

Here’s how it looks:

- APR: 24% per year

- Daily rate: 24% ÷ 365 = 0.0658%

That means every day, your credit card company is charging you 0.0658% on whatever you owe.

On a £2,000 balance:

- Day 1 interest: £1.32

- Day 2 interest: £1.32 + 0.0658% of £2,001.32…

Every single day you carry that balance, you’re getting charged. It doesn’t stop.

Now imagine doing that for months on end. That’s how your debt snowballs, even if you’re “making payments.”

Why Most People Don’t Know This

Here’s the truth: credit card companies aren’t in a rush to explain this stuff.

They’ll happily give you a shiny card with 0% for 12 months. They know most people won’t pay the full amount by the time that deal ends. And when it does? They start making money. Lots of it.

We live in a world where credit is easy, and understanding the terms is hard. It’s no surprise people get caught out. I did.

What You Can Do Instead

Once I realised what was happening, I made some big changes:

- I paid more than the minimum. Even just an extra £20 a month made a huge difference.

- I checked my APR on all my cards. Some were higher than others. I focused on paying off the highest-interest ones first.

- I set up a direct debit for fixed payments. That way I couldn’t just get lazy and pay the minimum again.

- I used a calculator to see exactly how much I could save.

That last one was a game changer. When I saw the real cost laid out in pounds and pence, it finally clicked.

Seeing It Clearly

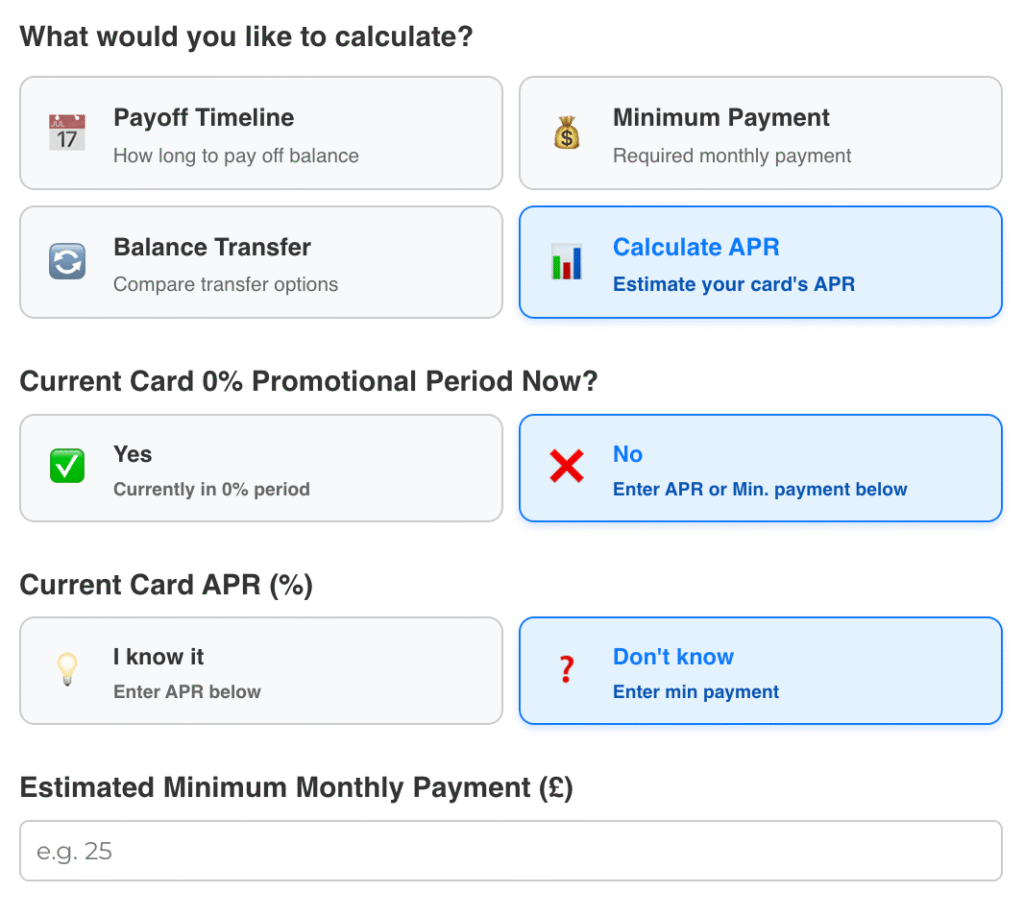

That experience was the reason I helped build Credit Card Calculator… Because I wanted something that actually made it clear what APR means.

You don’t need to understand all the maths. Just enter your balance, your monthly payment, and your APR if you know it. If you don’t, the calculator helps you figure it out based on your card statement.

It shows you:

- How long it’ll take to pay off your card

- How much interest you’ll pay in total

- What happens if you increase your payments

- Whether switching to a 0% card might help

It’s free, quick, and no one tries to sell you anything. I just wanted something I wish I’d had when I was in the same spot.

Why This Matters

Once you understand how APR works, you take back control.

It’s like turning on the light in a dark room. Suddenly you can see all the corners. You can make better choices. You’re not just reacting—you’re planning.

Credit cards aren’t evil. Used right, they can be incredibly useful. But they can also be expensive if you don’t understand how the charges work.

So here’s what I’d say to anyone reading this:

- Don’t wait until you’re hundreds of pounds in the hole.

- Don’t assume minimum payments are enough.

- And definitely don’t ignore your APR.

Take five minutes. Look it up. Use a calculator. Make a plan. You’ll thank yourself later & I wish I’d done it sooner.

James is a leading expert in UK personal finance (saving, investment & borrowing) - leading both Credit Card Calculator & ISA Interest Calculator tools. He has 8+ years of experience in personal finance, credit / borrowing & ISA savings. He has been regularly featured on several prominent business & investment-related sites in the UK. When he is not working he enjoys spending time with his daughter and hikes in the Scottish highlands.

Paul is an experienced financial advisor (IFA) and banking expert with 10+ years in the credit swap, default and risk analysis space for major banking institutions like Barclays and Halifax. He is a renowned speaker in the subject of personal finance and investment having featured in Forbes and Business Insider.