How Compound Interest Works on Credit Cards?

Credit Card Compound Interest Explained

Compound interest is one of those concepts you normally hear about in glowing terms. It’s the “eighth wonder of the world,” the magic behind savings and investing, the reason pensions grow.

But on credit cards? It’s the complete opposite.

Compound interest is why debts feel like they snowball, why balances drag on for years, and why even a small missed payment can sting.

So today, let’s break it down and actually calculate what compound interest does to your credit card balance. Spoiler: it’s not pretty, but once you understand it, you can take control.

What Is Compound Interest on Credit Cards?

Compound interest means you don’t just pay interest on your original borrowing, you pay interest on top of previous interest too.

Think of it like this:

- Day 1: You owe £1,000.

- Day 2: You owe £1,000 + £0.55 in daily interest.

- Day 3: You owe £1,000.55, so interest is charged on that slightly bigger amount.

It repeats every single day until you pay down the balance.

That’s why a card advertised at “19.9% APR” actually costs you slightly more than 19.9% a year in practice. The daily compounding pushes it higher.

What is Daily Compounding and Why it Matters

Credit card interest in the UK is charged daily, not monthly. APR is an annualised figure, but behind the scenes your bank is running a daily calculation.

Here’s the maths (don’t worry, I’ll keep it simple):

- Daily interest rate = APR ÷ 365.

- For a 19.9% APR card: 0.199 ÷ 365 = 0.000545 (or 0.0545% per day).

So every day your balance is multiplied by 1.000545. Over a year, that compounds to 1.219 — i.e. 21.9%, not just 19.9%.

That tiny difference, multiplied daily, is why debts feel heavier than you expect.

Practical Credit Compounding Example

Here’s a quick credit card compounding example for reference:

- Balance: £2,000

- APR: 24.9%

- Minimum payment: £50/month

Month 1:

- Daily rate = 24.9% ÷ 365 = 0.068%

- Daily interest = £2,000 × 0.00068 ≈ £1.36

- 30 days = £40.80 interest

So your £50 payment clears just £9.20 of debt.

Month 2:

- Balance = £1,990.80

- New interest = ~£40.50

- Payment clears another £9.50.

At this rate, it takes years to clear, because compound interest keeps resetting the balance upwards before you make progress.

Do Minimum Payments Help?

The minimum repayment trap is where compound interest really bites.

Credit card companies often set the minimum at 1–3% of your balance, or a flat £25–£50. Sounds manageable, but it barely dents the principal.

Example:

- £2,000 balance at 24.9% APR

- Minimum = 2% = £40/month

- Interest = ~£41/month

That means your payment doesn’t even cover the interest. Your debt grows despite paying. This is compound interest at its ugliest.

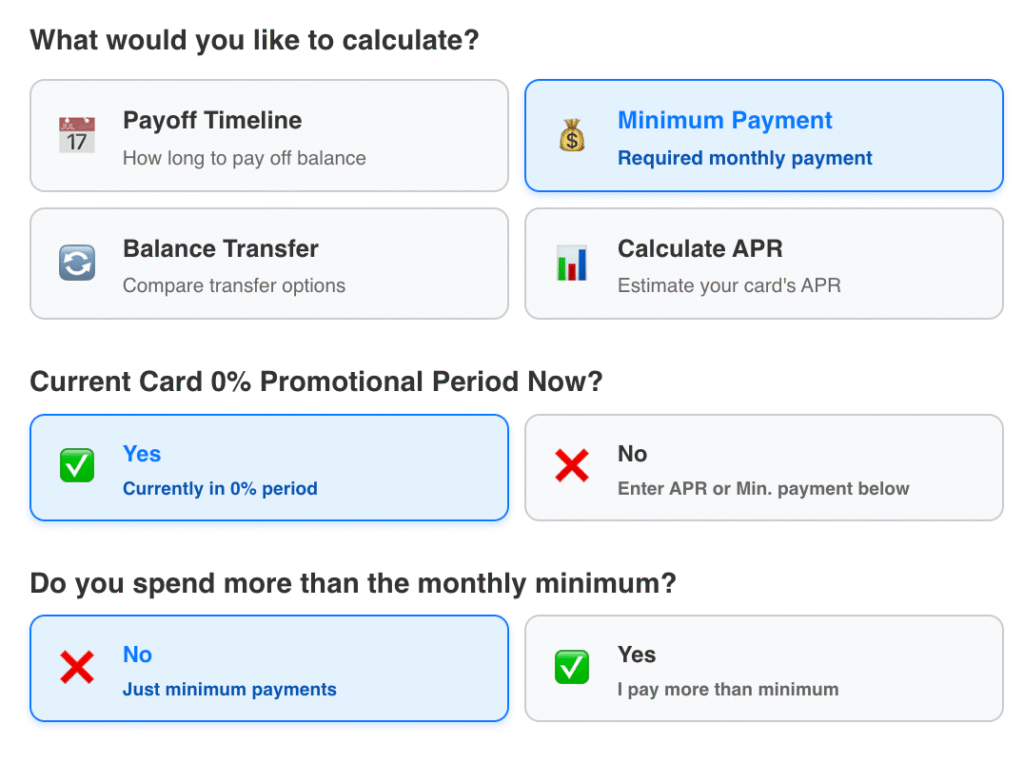

How to Calculate Compound Interest Yourself

Here’s how to calculate your credit card compound interest yourself. Bear in mind you could also use a credit card calculator to simplify this process. Ours automatically factors this into the calculations.

Here’s how to do it:

Future Balance = Current Balance × (1 + Daily Rate) ^ Days

So for £1,000 at 19.9% APR over 365 days:

- Daily rate = 0.199 ÷ 365 = 0.000545

- Future Balance = £1,000 × (1 + 0.000545) ^ 365

- Future Balance ≈ £1,219

So your £1,000 turns into £1,219 in a year — without spending another penny.

The “Magic” of Compound Interest… in Reverse

It’s worth remembering: the same mechanism that grows your ISA balance is the one that inflates your credit card bill.

- In savings: you get paid interest, and that interest earns more interest.

- In debt: you pay interest, and that interest charges more interest.

One works for you. The other works against you.

Real-Life Scenarios

Let’s play out three common ways to repay the credit card despite the compound interest:

Scenario 1: Paying the Minimum Only

- Balance: £3,000

- APR: 21.9%

- Minimum: £60/month (2%)

- Result: Takes over 15 years to clear, costing £2,800 in interest.

Scenario 2: Fixed £200/Month

- Same balance and APR

- Result: Clears in 18 months, costing ~£500 in interest.

Scenario 3: Overpaying by Just £50

- £250/month instead of £200

- Clears in 14 months, interest ~£400.

- Saves £100+ just by overpaying a little.

This is the brutal and beautiful reality of compounding: small changes make massive differences over time.

How It Differs from Loans and Mortgages

People often ask: why does credit card debt grow faster than loans?

- Personal loans usually charge simple interest.

- Mortgages charge compound interest, but at much lower APRs (3–6%).

- Credit cards charge compound interest daily at 20–40%.

So even though the maths is the same, the high rate + daily compounding = punishing costs.

Compound Interest vs APR

Let’s quickly clarify compound interest vs APR in relation to credit card compound interest:

- APR = Annual Percentage Rate, a headline figure including interest and certain fees.

- Compound interest = the effect of applying that APR daily.

That’s why a 19.9% APR actually “feels” more like 21.9% in reality.

Why Credit Card Debt Feels Endless

When you hear people say “I’ve been paying my card for years and it never goes down,” it’s usually because:

- Minimums are too low (barely covering interest).

- Compounding resets the balance daily.

- Extra spending keeps topping it up.

It’s not weakness or bad maths — it’s the system designed this way.

How to Beat Credit Card Compound Interest

Here’s how to beat the daily compounding on your credit card:

- Pay in full every month: no compounding, no interest.

- Overpay minimums: even £20 extra makes a huge impact.

- Balance transfer: 0% deals give breathing room, but only if you pay down before the promo ends.

- Automate repayments: set direct debits so you never miss a payment (missed payments trigger even higher penalty interest).

- Consider alternatives: personal loans at 5–10% can be far cheaper than 30% APR compounding on a card.

My Personal Wake-Up Call

In my 20s I had a cashback card at 27.9% APR. I thought I was clever and I’d pay it off each month and get the perks.

Then one month, car repairs wiped out my budget. I carried a £1,200 balance. I thought, “I’ll clear it in a couple of months.”

Six months later, I’d paid nearly £400 in interest. Every time I chipped away, the compounding dragged me back. That’s when I built my first spreadsheet to see the real numbers — which later turned into using calculators like this site.

It was shocking to say the least! Once I started overpaying by just £50, the debt vanished far quicker than I expected.

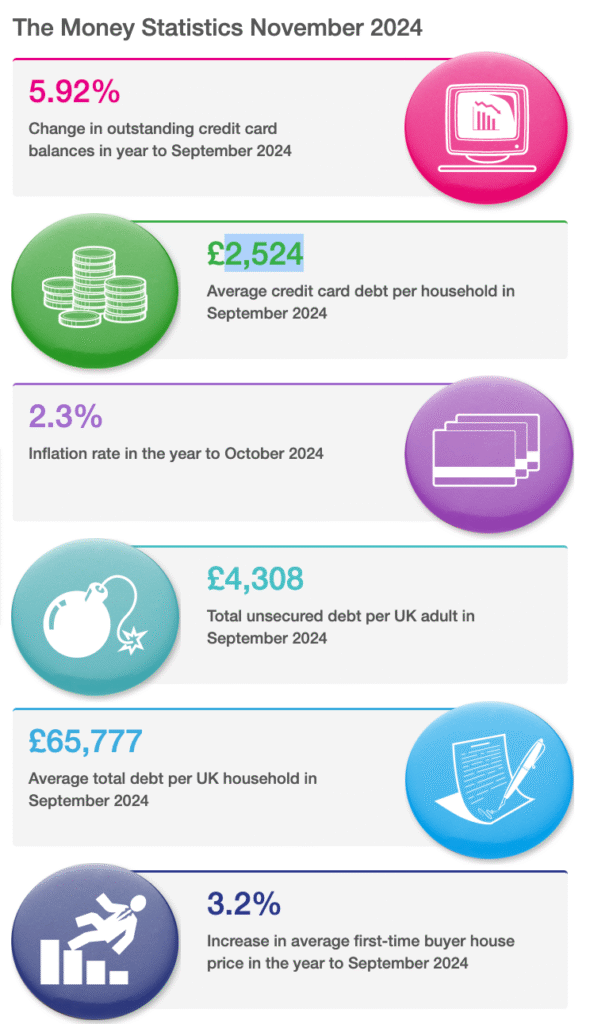

UK Debt Trends (2025 Context)

This isn’t just about me though, it’s about millions of households.

Here are the latest figures as of November 2024 for UK credit card debt:

- Outstanding UK credit card debt (according to the latest figures in November 2024): £71.68 billion .

- Average household card balance: £2,,885

- Average time to pay off balance if just paying minimum payments: 27 years

That means compound interest is quietly eating into almost half the nation’s debt pile, every single day.

Key Takeaways

- Compound interest is why credit card debt snowballs.

- APR looks simple, but daily compounding makes the true cost higher.

- Minimum payments = debt for decades.

- Overpaying even slightly slashes both time and cost.

- Calculators make the maths clear — and often shocking.

Final Thoughts

Compound interest isn’t just a maths lesson (I’ve learned this the hard way!) it’s the difference between staying stuck in debt and getting free of it.

On savings accounts, it’s your friend. On credit cards, it’s your enemy.

The real trick? Flip the script: stop it working against you by paying in full, overpaying, or switching to lower-cost borrowing.

If you’re curious (or a bit scared) about what compound interest is costing you, plug your numbers into our credit card calculator. It’ll show you how long your debt really lasts — and how much faster you can clear it with just a little extra effort.

Because the sooner you tackle compound interest, the sooner it stops tackling you.

Paul is an experienced financial advisor (IFA) and banking expert with 10+ years in the credit swap, default and risk analysis space for major banking institutions like Barclays and Halifax. He is a renowned speaker in the subject of personal finance and investment having featured in Forbes and Business Insider.