What is a Credit Card Calculator?

A year ago, I didn’t know what a credit card calculator was. Honestly, I didn’t even know I needed one. I thought I had a handle on my credit card — I made the minimum payments, didn’t use it for silly stuff, and figured everything would take care of itself.

It didn’t…

What I didn’t realise is how quickly credit card interest can pile up and how long it can take to pay off even a small balance. I was getting charged interest every single day, but I had no clue how much, or how long I’d be in debt if I just kept doing what I was doing.

That all changed when I started using a credit card calculator.

So, What Is a Credit Card Calculator?

In simple terms, a credit card calculator is a free online tool that helps you understand the true cost of your credit card. It can answer questions like:

- How much interest am I paying?

- How long will it take to pay off my balance?

- What will my monthly payments look like?

- Is a balance transfer actually worth it?

Instead of guessing or being surprised later, a credit card calculator lets you see the numbers clearly. It’s not about scaring you — it’s about helping you make better decisions.

And just to be clear: tools like a Credit Card Calculator don’t give you financial advice. They just help you understand your options in plain English, so you can decide what works best for you.

What Can a Credit Card Calculator Do?

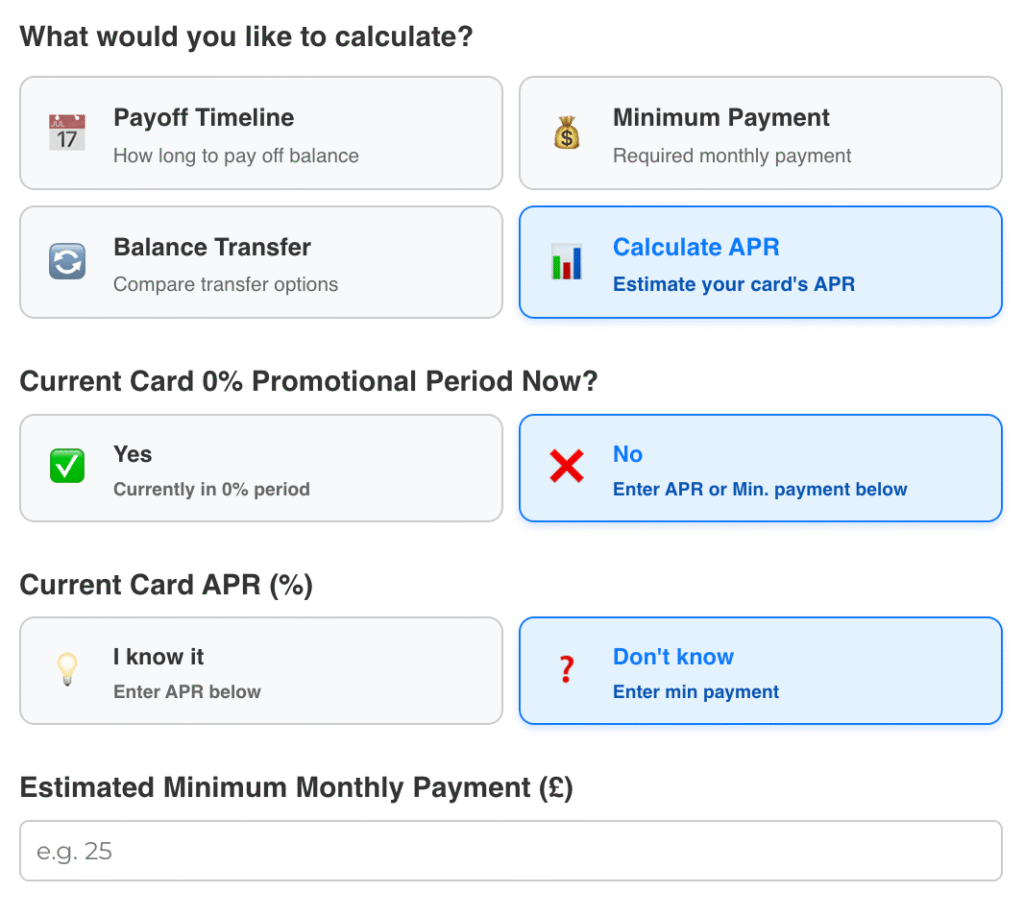

1. Estimating Your APR

Let’s say you don’t know your APR — the Annual Percentage Rate your credit card company charges. Most people don’t. I didn’t.

A credit card calculator can help estimate your APR based on your balance and your monthly payment. You just put in what you owe and how much you’ve been paying, and it does the rest.

Why does this matter? Because your APR affects everything: how much interest you’ll pay, how fast your debt grows, and how long it takes to get out of it.

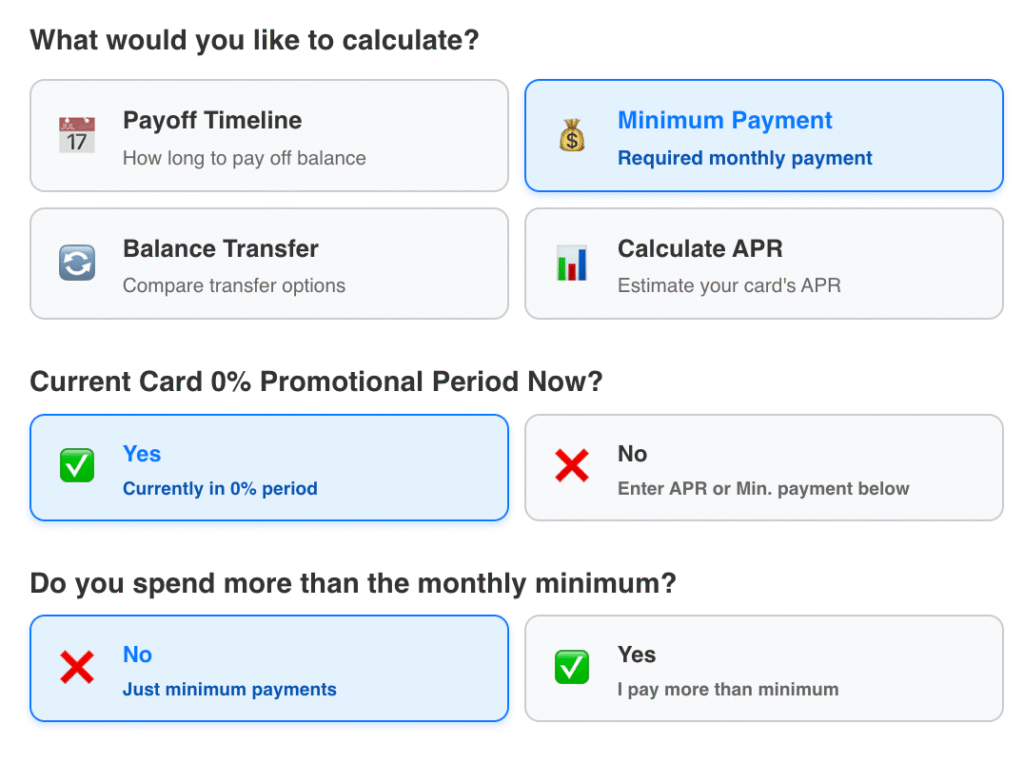

2. Figuring Out Your Minimum Payment

Sometimes you don’t know what your minimum payment should be. Or maybe your statement shows it but you want to see how different amounts would affect your balance.

The calculator lets you enter your balance and interest rate, and it will tell you the estimated minimum monthly payment you’ll need to make. This is especially useful if you’re planning your budget or want to understand what paying just the minimum really means long term.

Spoiler alert: minimum payments are not your friend if you want to get out of debt quickly.

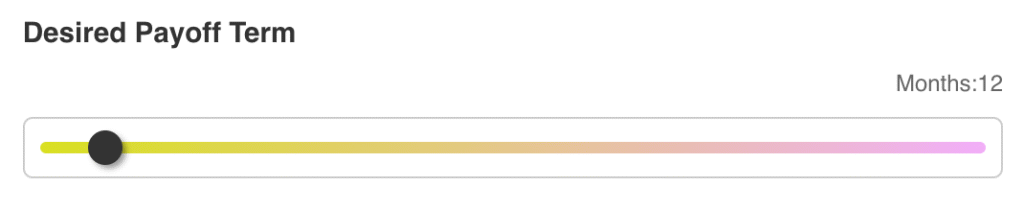

3. Estimating Your Payoff Timeline

This was the feature that really hit home for me.

When I first used the calculator, I entered my £2,500 balance, my minimum payment of £50, and my APR of 24%.

The result? It was going to take over 20 years to pay off the balance. And I’d end up paying more than £4,000 in interest alone.

That’s when I decided I had to do something different. The calculator showed me how much quicker I could be debt-free just by increasing my monthly payment to £80 or £100. This is the power of the credit card payoff option.

It’s all about seeing the full picture.

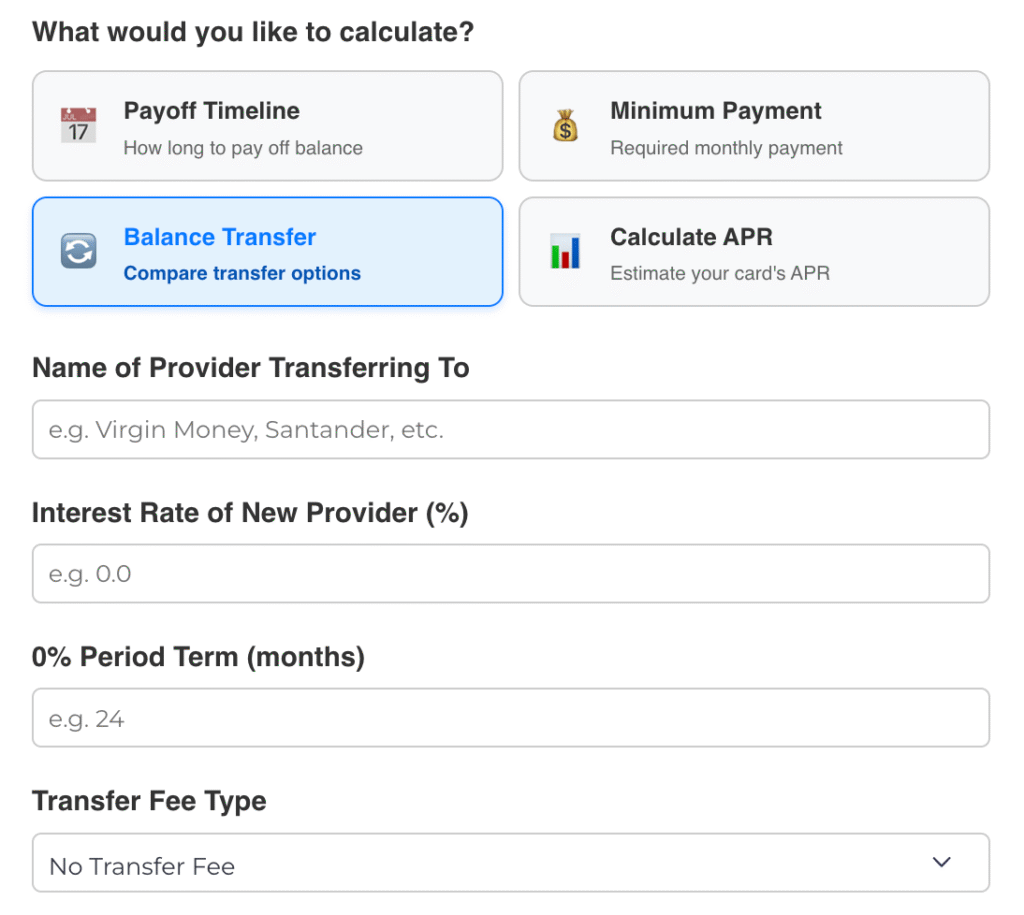

4. Balance Transfer Comparison

You’ve probably seen those offers for 0% balance transfers. But are they actually worth it?

A credit card calculator can help you figure that out. You can compare the cost of staying with your current card versus switching to a new one that offers 0% for a period of time (usually 12-24 months).

The tool can show you:

- Whether the transfer fee is worth it

- How much interest you’ll save

- How quickly you can pay off the balance before the 0% period ends

It’s not about pushing you to switch. It’s about giving you the numbers so you can decide if it makes sense to do a balance transfer.

Why This Tool Exists

When we created this site, it wasn’t to sell anything or give complicated advice. It was because I had been caught out by not knowing the numbers. I kept making payments without understanding what they were doing (or not doing).

This calculator exists to help regular people:

- Make sense of their credit card costs

- Plan better monthly payments

- Avoid unnecessary interest charges

- Decide if switching cards might help

You don’t need to know financial jargon. The tool asks simple questions and shows clear answers. No judgement. No signups. No hassle.

Caveat: This Isn’t Financial Advice

Let’s be clear. This calculator and article are not giving financial advice. Everyone’s situation is different, and what works for one person might not work for another.

What we offer is information. Educational support. A way to see your options, compare them, and feel a bit more confident in how you manage your money.

If you’re struggling with debt, you should always speak to a qualified advisor. But if you’re just trying to understand your credit card better? A calculator like this is a brilliant first step.

Final Thoughts

I used to feel like my credit card was a mystery. Every month I paid, and every month I stayed in the same place.

Using a credit card calculator changed that. I saw the numbers. I saw how much interest I was paying. I saw how small changes to my payment made a big difference over time.

If you’re carrying a balance, wondering what your APR is doing to your payments, or thinking about switching cards — take five minutes. Try the calculator. See the truth behind your credit card.

Because when you understand what’s really going on, you can do something about it.

And that feeling? It’s worth more than any rewards points or cashback.

Emma is the lead developer for credit card calculator. She works with the team to build comprehensive credit card calculation tools & financial tools. With a background in web and mobile development, she brings years of experience to the credit card space and developer space. When she is not working, she likes spending time with her daughter, Grace, and two dogs, Lulu & Baxter.