Why You Should Calculate Your Credit Card.

When I first got a credit card, I treated it like a backup wallet. Use it when I needed it, pay off a bit each month, and repeat. I didn’t really know what the interest rate was. I didn’t understand how the minimum payment worked. I figured as long as I wasn’t missing payments, I was being responsible.

Spoiler: I was wrong.

What I didn’t realise was that credit cards come with rules that quietly cost you money if you don’t understand how they work. And once I started actually calculating my interest and payments, I saw how easy it was to fall behind—even when you think you’re doing everything right.

Why Calculate Your Credit Card in the First Place?

If you’ve ever thought, “I’ll just pay the minimum and deal with the rest later,” this part’s for you.

Calculating your credit card means understanding things like:

- How much interest you’re actually paying

- How long it’ll take to pay off your balance

- What effect your monthly payments have

- Whether a 0% offer is helping you or setting you up for a fall

- Whether a balance transfer will really save you money

These numbers matter. And most of the time, your bank won’t break them down for you in a clear way.

What Happens If You Don’t Calculate Your Credit Card?

Here’s what happened to me:

- I had a balance of around £2,000

- I was paying £50/month

- I thought I was making progress

But when I looked closer (with the help of a credit card calculator), I realised almost all of that payment was going to interest, not the actual debt.

At that rate, I’d be paying the card off for 20+ years, and I’d spend more than £2,500 in interest.

If I’d kept going like that, I’d have paid more in interest than I borrowed.

Credit Card Statements Aren’t Always Obvious…

Credit card statements are designed to show you:

- What you spent

- What you owe

- What your minimum payment is

They don’t show you:

- How much interest you’ll pay if you only make that minimum

- How much quicker you could be debt-free by adding just £20 more

- What the actual APR means in pounds and pence

- The impact of a balance transfer fee versus interest saved

That’s where credit card calculators come in. Tools like our APR Calculator break the fog. You enter your balance, interest rate, and payments, and it shows you the true cost over time.

No jargon. No assumptions. Just honest numbers.

What You Can Calculate (And Why It Matters)

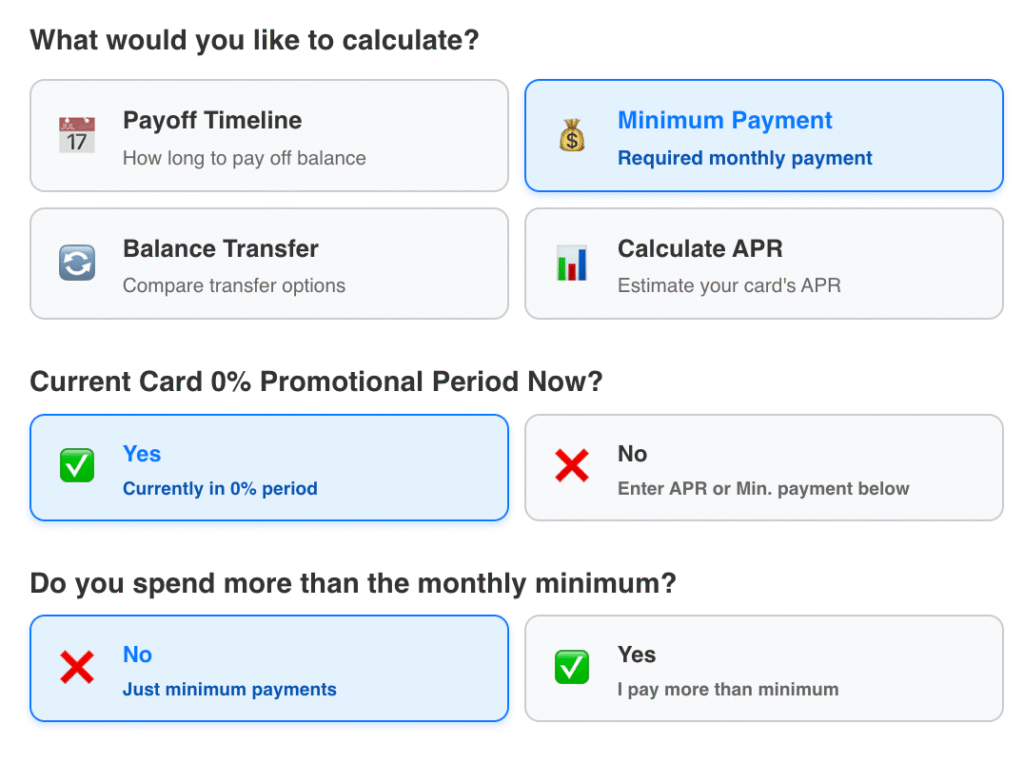

On credit card calculator and other online calculator sites, you can calculate the following:

1. Minimum Payment Timeline

If you only pay the minimum, how long will it take to pay off your card? You might be shocked by the answer. For many people, it’s 15 to 25 years.

Calculating this gives you the reality check you need to start paying more, even if it’s just an extra £10–£20 a month.

2. Interest Over Time

That 24% APR doesn’t sound too scary until you see it in pounds. On a £3,000 balance, it could mean over £2,000 in interest paid over time. Seeing that number up front helps put things in perspective.

3. Balance Transfer Comparison

Thinking of switching to a 0% card? Calculate:

- How much the transfer fee will cost (usually 2-3%)

- How much interest you’ll avoid during the 0% period

- Whether you’ll clear the balance before the promo ends

It’s not always a yes/no answer. But calculating both sides makes the decision smarter.

4. Payment Planning

Let’s say you can afford £100 a month. What if you paid £150 instead? Use a calculator to:

- See how many months you’ll save

- See how much interest you’ll avoid

- Set a realistic debt-free goal

5. 0% Promotional Expiry Forecasting

You might have a 0% interest deal for 12 or 18 months. If you know when that ends and what your balance will be by then, you can prepare. Either pay it off in time or plan your next move.

Calculators help you estimate how much will remain—and what the cost will be if you don’t pay it in full before the rate changes.

Credit Cards Are a Long Game

Credit card debt isn’t just about what you owe today. It’s about how your repayment choices shape the next one, five, even ten years.

Calculating your credit card helps you play the long game on your terms:

- Less guesswork

- More control

- Fewer surprises

It doesn’t matter if you’re just getting started or halfway through paying off a balance—seeing the whole picture changes how you think.

You Don’t Need to Be a Finance Expert

Most people avoid doing these calculations because they think it’ll be complicated or they don’t want to see the truth. I was the same.

But once I did it, I actually felt relieved. I finally knew where I stood. And knowing meant I could do something about it.

You don’t need a spreadsheet or a finance degree. You just need a tool that breaks it down for you in plain English.

Final Thoughts

Credit cards aren’t evil. But they’re easy to ignore—and expensive when you do.

Calculating your credit card costs isn’t about shame or blame. It’s about awareness. Whether you’re trying to pay down a balance, considering a balance transfer, or just want to understand how your card works, it’s worth running the numbers.

Because the sooner you see the full picture, the sooner you can take control. And that starts by doing something as simple as clicking on a calculator and seeing what’s really going on behind your statements.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always speak to a qualified adviser if you need guidance tailored to your situation.

Emma is the lead developer for credit card calculator. She works with the team to build comprehensive credit card calculation tools & financial tools. With a background in web and mobile development, she brings years of experience to the credit card space and developer space. When she is not working, she likes spending time with her daughter, Grace, and two dogs, Lulu & Baxter.