How To Calculate Balance Transfers.

The Real Costs of Balance Transfers

Balance transfers are great…, right? Well, I thought I’d found the secret weapon for beating debt. Move your credit card balance to a new card with 0% interest for 18 months? Yes, please. It sounded like a no-brainer.

But after doing a few of these transfers (some good, some not-so-good), I realised something: the maths matters.

You can absolutely save money with a balance transfer. But if you don’t take the time to calculate the actual cost, you could end up worse off than when you started.

Let me show you how to work it out, and what to look out for.

What Is a Balance Transfer?

A balance transfer lets you move your existing credit card debt to a new card that offers a lower interest rate — often 0% for a limited time.

The idea is simple: give yourself breathing room from interest so you can pay down the debt faster. But the offer usually comes with:

- A balance transfer fee (typically 2-3% of the amount transferred)

- A limited 0% window (e.g., 12, 18 or 24 months)

- A higher APR after the promo ends

So, while it can be a great way to save money, it’s only smart if you understand the maths behind it.

The Key Things You Need to Know

To calculate if a balance transfer is worth it, you need four pieces of info:

- Your current credit card balance

- Your current interest rate (APR)

- The transfer fee on the new card

- The duration of the 0% interest period

Optional but useful:

- What you can afford to pay each month

- What the APR will be after the 0% period ends

Once you have those, you can work out how much interest you’d pay if you stayed on your current card vs. how much you’d pay with the new card including the transfer fee.

Let’s break it down with some examples.

Example 1: No Balance Transfer

Say you owe £3,000 on a card charging 24% APR. You’re paying £80/month.

Using a credit card calculator (like CreditCardCalculator.co.uk), you’d see that:

- It would take about 5 years to pay off the balance

- You’d pay around £2,000 in interest

Ouch.

Example 2: The Cost of a Balance Transfer

Now, suppose you get a new card offering 0% interest for 18 months and a 2.5% transfer fee. So:

- £3,000 x 2.5% = £75 transfer fee

- You continue paying £80/month

At that rate, you’d pay:

- £1,440 over 18 months (£80 x 18)

- £75 transfer fee

- Remaining balance: £1,560

Now here’s the key: after 18 months, the interest rate jumps to, say, 21% APR. So if you don’t pay it off before the offer ends, the clock starts ticking again.

How to Calculate If It’s Worth It

So, it it worth it? Well, the real benefit of a balance transfer comes if you can pay off the balance before the 0% period ends.

In the example above:

- If you increased your payment to £167/month, you’d clear the £3,000 in 18 months

- Your only cost would be the £75 fee

- You’d save nearly £2,000 in interest

But if you only paid the minimum or something low like £80/month, a lot of that balance would still be left after the 0% deal expires.

At that point, you’re back to high interest, and that “free money” feeling disappears fast.

Things People Forget to Factor In

1. Balance Transfer Fees Add Up

If you’re transferring a big balance, even a 3% fee can cost a lot. £5,000 x 3% = £150 just to move the money. That needs to be included in your decision.

2. Not All Purchases Are Covered

Sometimes new purchases on the card don’t get the 0% deal. So if you start spending, you could be getting charged interest from day one on those items.

3. Late Payments Cancel the Deal

If you miss a payment, many banks can cancel your 0% offer. Suddenly you’re paying the standard rate again. One mistake can cost you hundreds.

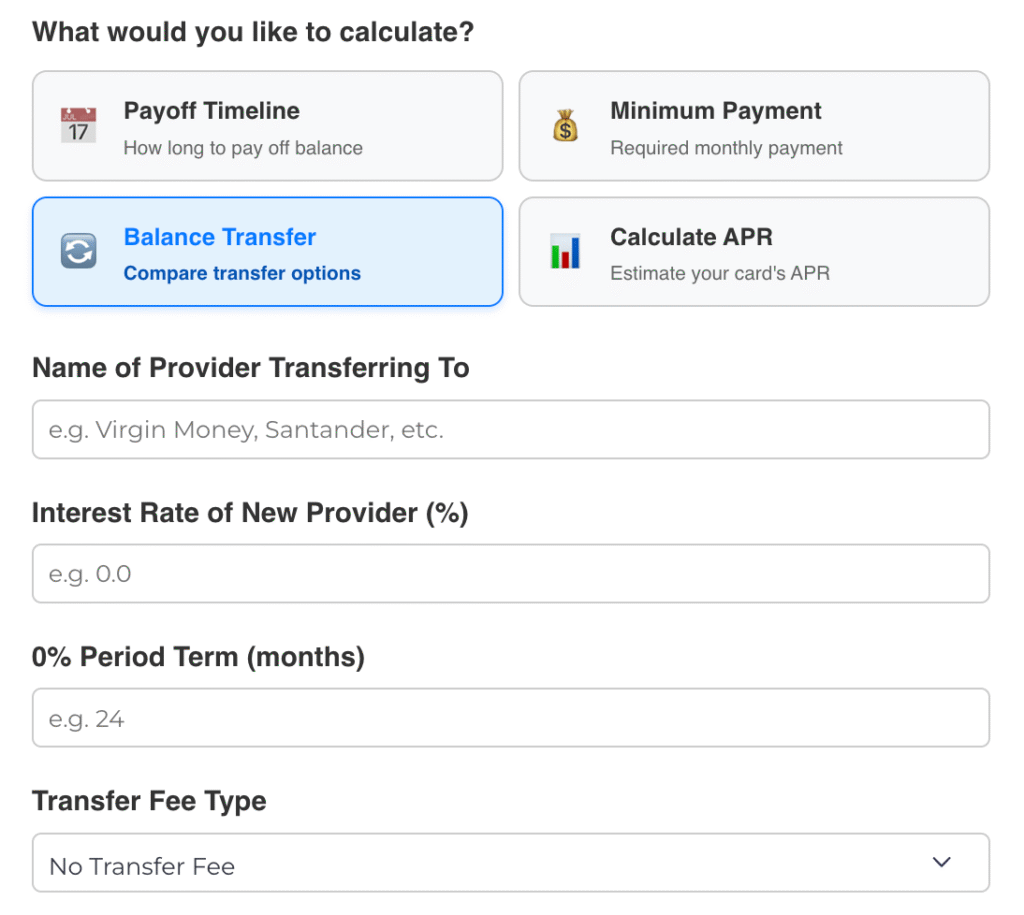

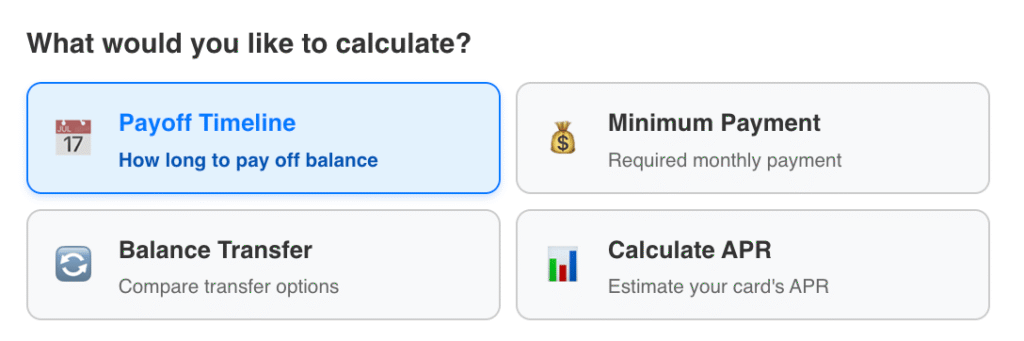

The Easy Way to Do the Maths

Instead of trying to work this all out on the back of a napkin – just use a Credit Card Calculator like ours.

You enter:

- Your balance

- The transfer fee (or let the tool calculate it)

- The interest-free period

- Your monthly payment

And it shows you:

- What your total cost will be

- Whether you’ll pay it off in time

- How much you’ll save compared to staying with your current card

It doesn’t offer financial advice. But it gives you the numbers so you can make the best choice for your situation.

Final Thoughts

Balance transfers can be powerful tools. But only if you treat them like a strategy, not a shortcut. Here’s when it could be a good idea:

- You can comfortably afford to pay off the balance during the 0% period

- You don’t plan to use the new card for spending

- You track your payments and don’t miss deadlines

- The transfer fee is lower than the interest you’d otherwise pay

And here’s when it could be a bad move…:

- You’re already struggling to make payments

- You’re likely to use the card for new purchases

- The 0% period is too short to make a real dent in your debt

- The transfer fee is too high

Do the maths before you move your balance. Use a calculator to see what the numbers look like over time. And make sure the 0% period gives you enough space to actually clear the debt.

Otherwise, that shiny new card could end up being just another debt trap.

Disclaimer: This article is for informational and educational purposes only. It is not financial advice. Always speak to a qualified adviser if you need help with your financial situation.

Paul is an experienced financial advisor (IFA) and banking expert with 10+ years in the credit swap, default and risk analysis space for major banking institutions like Barclays and Halifax. He is a renowned speaker in the subject of personal finance and investment having featured in Forbes and Business Insider.